The National Revenue Authority wishes to inform the Public that the deadline for filing the Goods and Services Tax (GST) Returns for March is due on or before 30th April 2023.

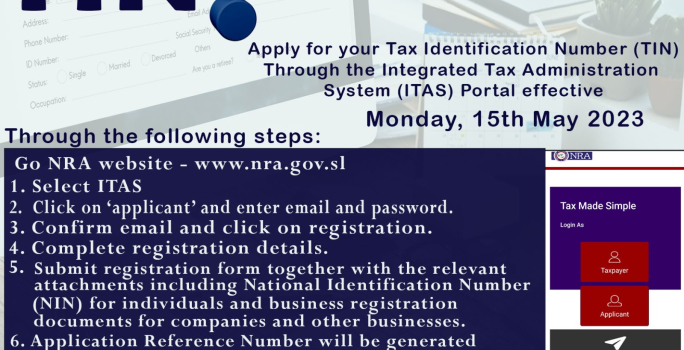

Please note that filing of Returns and payment of related taxes should be done via the Integrated Tax Administration System (ITAS) portal.

Penalties and interest will be charged for non-filing and payment of taxes on the due dates.

By Order of the Commissioner General !